Navigate SEC Climate Disclosures with EcoActive ESG

Effortlessly align with the SEC’s climate-related disclosure requirements.

The SEC Climate Disclosure Challenge

What’s Next: A Closer Look at Compliance Timelines

Moving Forward

As companies navigate this transition, leveraging technologies and platforms like EcoActive ESG becomes indispensable. These tools offer the capabilities to streamline data management, ensure compliance with reporting standards, and provide the analytics needed to inform strategic decision-making. By integrating such solutions, businesses can address the SEC’s climate disclosure requirements efficiently, turning regulatory compliance into an opportunity for enhanced transparency, investor engagement, and sustainable growth.

Why EcoActive ESG?

Key Features

Targeted Data Collection and Management

Climate Risk Analysis and Reporting

Scenario Analysis and Strategic Planning

iXBRL Capabilities for Streamlined Compliance and Analysis

Benefits for Your Business

Streamlined Compliance Process

Enhanced Reporting Accuracy

Strategic Insights

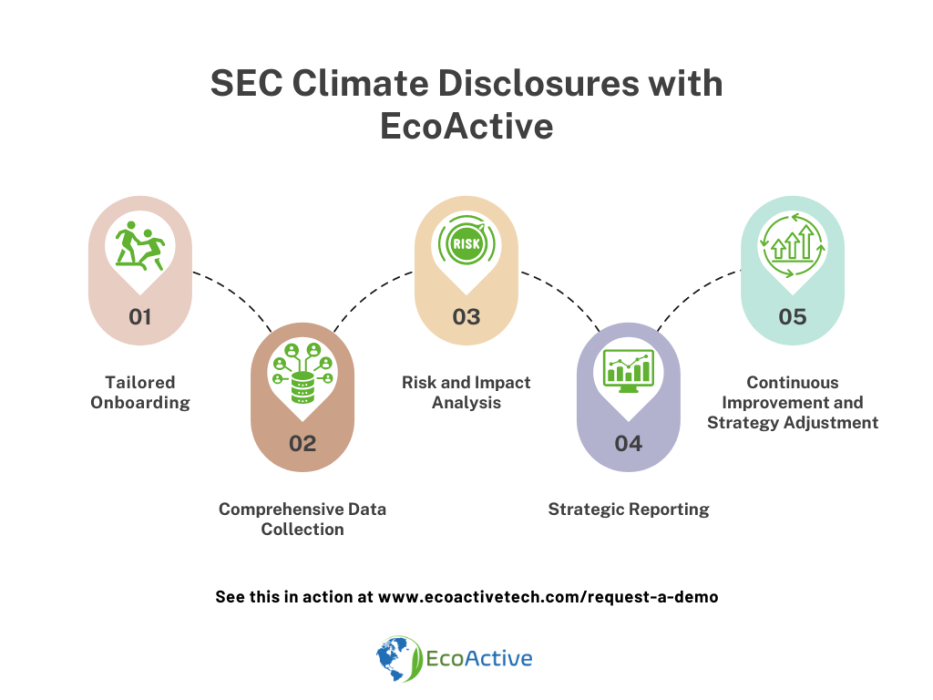

How It Works: Ensuring Compliance with SEC Climate Disclosures using EcoActive ESG

EcoActive ESG's approach to simplifying SEC climate disclosure compliance is intuitive and comprehensive, covering every step of the reporting process. Here's how businesses can leverage EcoActive ESG:

Step 1: Tailored Onboarding

Step 2: Comprehensive Data Collection

Step 3: Risk and Impact Analysis

Step 4: Strategic Reporting

Step 5: Continuous Improvement and Strategy Adjustment

EcoActive ESG: Your Ally in SEC Climate Disclosure Compliance

Choosing EcoActive ESG for your ESG reporting and compliance needs goes beyond leveraging a sophisticated software platform. It’s about harnessing deep expertise and comprehensive support in navigating the evolving landscape of ESG disclosures.

Here’s why EcoActive ESG stands out:

Deep Expertise in XBRL

Financial Reporting Experience

Expertise in Financial & Sustainability Domain for Integrated Reporting

Addressing Various Jurisdictions Over 12 Years

In choosing EcoActive ESG, you’re not just selecting a tool for ESG compliance; you’re partnering with a team of experts dedicated to elevating your sustainability reporting. Let us guide you through the complexities of ESG disclosure, turning compliance into a strategic advantage for your business.

Ready to Simplify Your SEC Climate Disclosure Compliance?

Additional Services by EcoActive ESG Team

Beyond our platform, the EcoActive ESG team offers bespoke consulting services led by experts like Dr. Kaushik Sridhar to support your specific needs in SEC climate disclosure compliance. From initial strategy development to detailed risk analysis and reporting guidance, our experts are here to ensure your success every step of the way.

Discover how our services can elevate your climate reporting efforts. Contact us today for more details or to schedule a consultation.

SEC Climate Disclosures FAQs

The SEC has proposed a phased-in approach, giving additional time for smaller reporting companies.

- Larger Accelerated Filers (LAFs) will need to comply with new disclosures, GHG emissions/assurance, and electronic tagging requirements starting in the Fiscal Year Beginning (FYB) 2025, with full compliance including reasonable assurance for GHG emissions by FYB 2033.

- Accelerated Filers (AFs), excluding Smaller Reporting Companies (SRCs) and Emerging Growth Companies (EGCs), will begin compliance in FYB 2026, moving towards GHG emissions disclosure and Inline XBRL tagging by the same year, with the transition extending through FYB 2031 for certain audits.

- SRCs, EGCs, and Non-Accelerated Filers (NAFs) are set for a later start in FYB 2027, with no applicable deadlines for certain GHG emissions assurances, reflecting a tailored approach to different entities' capacities and obligations under the new regulatory framework.

- Scope 1 emissions are direct GHG emissions from sources that are controlled or owned by an organization (e.g., emissions from company vehicles).

- Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heating, or cooling.

- cope 3 emissions are all indirect emissions not included in scope 2, occurring in the value chain of the reporting company, including both upstream and downstream emissions.

Companies can prepare by:

- Assessing current GHG emissions and climate risk management practices.

- Establishing robust internal reporting and verification processes.

- Engaging with stakeholders to understand their concerns and expectations.

- Implementing or enhancing systems to track and manage relevant data.

- Seeking external support for assurance and compliance strategy.

Have more questions about the SEC’s climate disclosure requirements or how EcoActive ESG can help your company comply? Our team is here to provide the expertise and support you need. Contact us today for personalized assistance.

Book a Demo to see how EcoActive ESG can simplify your compliance process.