Simplify SB 253 & SB 261 Compliance

Stay ahead of California’s Climate Disclosure laws SB 253 and SB 261 with EcoActive ESG.

An AI-powered platform that simplifies reporting, automates workflows, and gets you audit-ready from the start.

What Are SB 253 & SB 261?

California has introduced landmark climate disclosure laws designed to hold companies accountable for both their environmental impact and their financial exposure to climate risks. Together, these laws set a new benchmark for corporate transparency.

SB 253: Requires companies to disclose their greenhouse gas emissions across Scopes 1, 2, and 3.

SB 261: Focuses on disclosure of climate-related financial risks and how they are managed.

Together: They form California’s Climate Accountability Package, establishing a unified framework for emissions and risk disclosure in the state.

Who Must Comply?

Threshold: SB 253 applies to companies with over $1B in annual revenue doing business in California. SB 261 applies to companies with over $500M in annual revenue starting in 2026.

Applicability: Includes U.S. and international firms with significant business operations in California, regardless of headquarters location.

Purpose: Ensures that organizations with major economic presence and emissions impact are held accountable for transparent reporting.

Important Dates for SB 253 & SB 261 Compliance

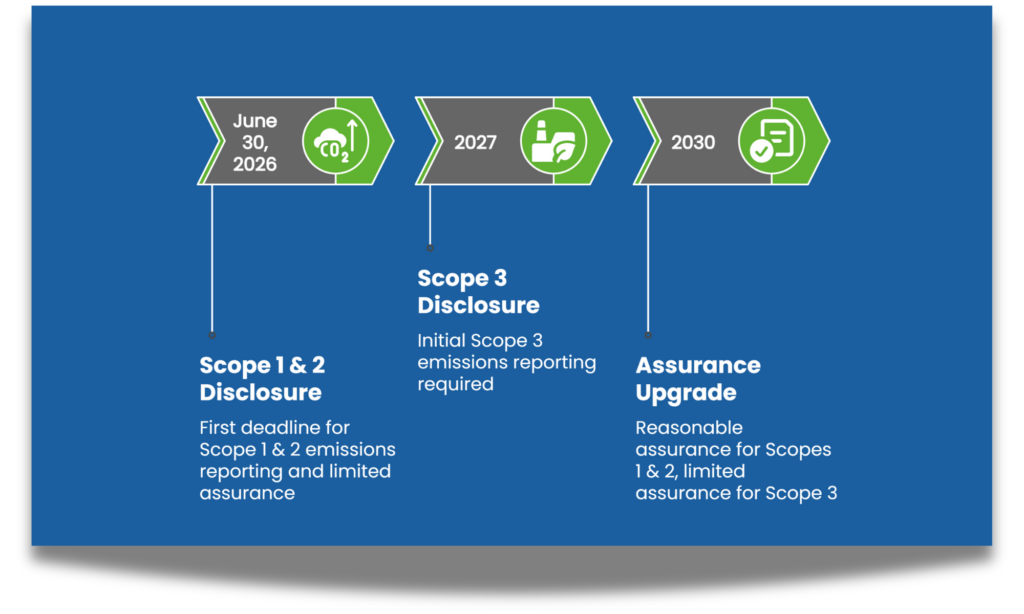

These disclosure requirements are overseen by the California Air Resources Board (CARB), often referred to as the CARB 2026 framework.

- 2026*: Scope 1 & 2 disclosures (for 2025 data); Limited assurance. Deadline: June 30, 2026

- 2027: Scope 3 disclosures (for 2026 data)

- 2030: Reasonable assurance for Scopes 1 & 2, limited assurance for Scope 3

Disclosure Requirements

Scope 1

Scope 2

Scope 3

EcoActive ESG: Your Partner for Seamless Compliance

Data Integration

Free Integrated GHG Calculator

InDesign Integration

XBRL/iXBRL Reporting

Smart Reporting

Audit & Assurance

Turn Compliance into a Strategic Advantage

Why EcoActive ESG?

AI From the Start

Process Driven Reporting

Guided Support

Trusted. Certified. Proven.

Enterprise Clients

Certifications

Recognition

Frequently Asked Questions

Do companies headquartered outside California need to comply?

Yes. Both SB 253 and SB 261 apply to U.S. and international companies if they meet the revenue thresholds and do business in California.

What are the revenue thresholds for SB 253 and SB 261?

SB 253 applies to companies with more than $1B in annual revenue. SB 261 applies to companies with more than $500M in annual revenue starting in 2026.

What do SB 253 and SB 261 require?

SB 253 requires disclosure of greenhouse gas emissions, while SB 261 mandates reporting of climate-related financial risks. Both laws are overseen by the California Air Resources Board (CARB).

What happens if companies don’t comply?

Noncompliance carries penalties and reputational risks. Early adoption ensures smooth compliance and stakeholder trust.