Canadian ESG Reporting: Navigating Evolving Standards and Requirements

Canada’s ESG Regulatory Reporting Requirements

Canada is an important region for environmental, social and governance (ESG) laws, regulations, and investor disclosure. In line with other major financial centers like New York, London, and Hong Kong, Canada’s government and security regulators are increasingly integrating ESG factors and reporting requirements for companies publicly traded on the Toronto Stock Exchange (TSX), and elsewhere, such as sustainable government procurement tenders.

Key Canadian ESG Reporting Standards, Rules & Requirements in 2023

Corporate Diversity Reporting – Corporations Canada requires corporations to report annually on the diversity of their board of directors and senior management. Corporations have to report on the representation of 4 designated groups defined in Canada’s Employment Equity Act, on their board of directors and senior management teams: (1) women, (2) Indigenous peoples (First Nations, Inuit and Métis), (3) persons with disabilities, and (4) members of visible minorities.

Canadian Securites Administrators (CSA) Corporate ESG Reporting and Disclosure – The CSA regulates securities and publicly traded companies in Canada. In November 2022, the CSA outlined a notice on ESG reporting by issuers where the agency shared guidance designed to discourage “greenwashing” and unsubstantiated ESG claims. The CSA’s view is all ESG claims and disclosure should be factual, balanced, and substantiated. Moreover, commentary on ESG targets and forecasts may constitute forward-looking information (“FLI”). We expect more ESG reporting requirements are likely in the future to align disclosure with ESG reporting requirements in other financial markets like the UK, Hong Kong, and the European Union (EU).

CSA ESG Investment Fund Disclosure – In 2022, the CSA also outlined ESG disclosure guidance for investment funds. This guidance applies to all investment funds that either (a) focus on ESG as a core strategy or investment objective, or (b) consider ESG investment risk and opportunity factors as part of their investment process.

Supplier ESG Disclosure for Large Federal Contractors – Large suppliers to the Government of Canada are required to disclose their greenhouse gas (GHG) emissions and set targets to reduce them, starting April 1, 2023, according to new the new “Standard on the Disclosure of Greenhouse Gas Emissions and the Setting of Reduction Targets” rule. This rule applies to federal procurements greater than $25 million.

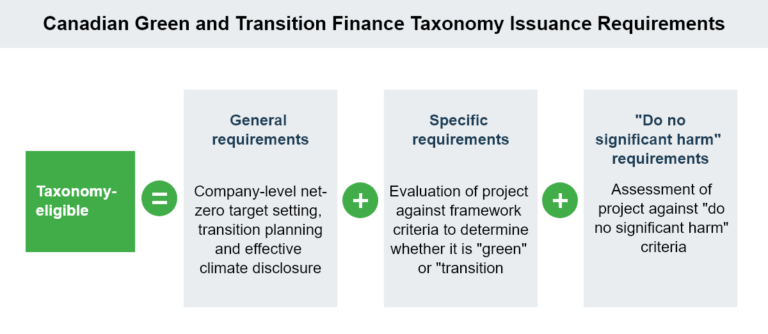

Canada’s Climate Investment Taxonomy – In March 2023, the Sustainable Finance Action Council (SFAC) in the Department of Finance Canda released its Taxonomy Roadmap Report, featuring a framework to establish standardized definitions of climate-compatible investments, similar to the EU Taxonomy on Sustainable Activities. The “Canadian Green and Transition Financial Taxonomy” framework, backed by Canada’s 25 largest financial institutions, is being designed to help align capital flows and investments with Canada’s climate targets and economic opportunities

Canada’s CSA plans to start requiring ESG reporting and climate disclosures from large Canadian banks, insurance companies, and federally regulated financial institutions in 2024. Canadian listed companies also need to comply with certain ESG-related provisions, such as gender diversity disclosure related to board composition.

EcoActive is a cloud-based iXBRL platform that enables corporations to prepare, review, validate, and file reports to various Regulators. EcoActive provides iXBRL taxonomy supports for the SASB and TCFD for regulatory purposes. EcoActivex platform can accommodate new frameworks and upcoming taxonomies easily with user friendly features.

XOR is the industry’s best collaborative solution for reviewing Inline XBRL filings submitted to regulators. XOR provides a combination of powerful features, including a portal for document management and version control, automated and configurable notifications, online reviewing of all types of iXBRL documents, and rich set of reports.

Canada CSA climate change-related disclosure:

- Aligns with TCFD framework.

- Net-zero greenhouse gas emissions

Our SAAS based disclosure management platform allows:

- Preparation of regulatory reports

- Automates the generation of XBRL

- Ensures accuracy and compliance

XOR a multi-user cloud-based online XBRL review platform allows:

- Review of ixbrl filings.

- Built-in validation reports

- Workflow management capabilities.