Introduction

As the world moves rapidly toward transparency in sustainability, Canada has taken a significant step with its own sustainability disclosure framework—the Canadian Sustainability Disclosure Standards (CSDS). Developed by the Canadian Sustainability Standards Board (CSSB), CSDS 1 and CSDS 2 aim to bring structure, comparability, and credibility to how Canadian companies report environmental, social, and governance (ESG) information.

But is it mandatory? What do businesses need to disclose? How does it compare to global standards like the ISSB’s IFRS S1 and S2? This guide answers all your questions—minus the jargon.

Overview at a Glance

What Is CSDS?

The Canadian Sustainability Disclosure Standards are a set of national ESG reporting standards aligned with the global IFRS S1 and S2 frameworks but tailored for the Canadian context. These two initial standards include:

- CSDS 1: General Requirements for Disclosure of Sustainability-related Financial Information.

- CSDS 2: Climate-related Disclosures.

Developed by the Canadian Sustainability Standards Board (CSSB)—a body under the Financial Reporting & Assurance Standards Canada—the CSDS aims to:

- Align Canadian ESG disclosures with international best practices.

- Enhance organizational resilience and long-term value creation.

- Support companies in communicating ESG risks and opportunities.

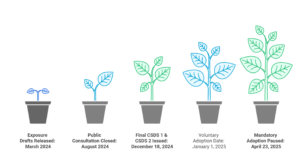

The Story So Far: Timeline and Current Status

The Canadian Securities Administrators (CSA) initially proposed mandatory adoption but paused rulemaking to observe evolving standards in the U.S. (SEC) and EU (CSRD). This means CSDS is voluntary for now but likely to become mandatory in the near future.

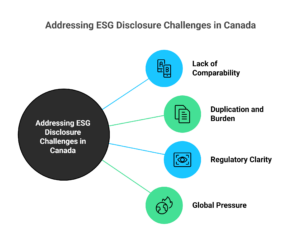

Why Did Canada Need Its Own Sustainability Standards?

Before CSDS, ESG disclosures across Canada were fragmented. Companies used a mix of international and voluntary frameworks—like TCFD, GRI, and SASB—leading to inconsistencies in how information was reported, interpreted, and assured.

Key Issues the CSDS Aims to Solve:

- Lack of comparability: Investors and stakeholders couldn’t benchmark ESG performance reliably due to varying disclosure practices.

- Duplication and burden: Multiple overlapping frameworks increased reporting costs and complexity for businesses.

- Regulatory clarity: There was no single Canadian standard guiding ESG disclosures.

- Global pressure: As other jurisdictions adopted mandatory frameworks (EU CSRD, U.S. SEC), Canada needed a coherent national response.

As stated in the CSSB’s Strategic Plan, the goal is to ensure Canadian disclosures are “fit for purpose” and aligned with global best practices while still addressing national regulatory and sector-specific needs.

Key Features of CSDS 1 and CSDS 2

Let’s break it down simply.

CSDS 1: General Sustainability Disclosures

This standard outlines how sustainability information should be reported, regardless of the topic (climate, human rights, biodiversity, etc.).

You must disclose:

- Governance: Who oversees ESG risks?

- Strategy: What is the company’s plan to manage sustainability risks and opportunities?

- Risk Management: How are ESG risks identified and managed?

- Metrics and Targets: What data do you track and what are your goals?

CSDS 2: Climate-related Disclosures

Focuses specifically on climate change. Includes:

- Scope 1 and Scope 2 GHG emissions

- Scope 3 (optional initially)

- Climate transition plans

- Scenario analysis

- Climate-related financial impacts

Is CSDS Mandatory?

No, not yet. But here’s the nuance:

- Voluntary from Jan 1, 2025: Companies can start applying CSDS 1 and 2.

- Mandatory adoption was paused by CSA on April 23, 2025.

- Why the pause? Due to uncertainty in global regulatory directions (especially in the U.S. and EU).

- Future intent? The CSA will likely revisit mandatory adoption when international frameworks settle.

Current requirements:

Even with CSDS voluntary, companies must still disclose material ESG risks under existing Canadian securities law.

Materiality: The Backbone of CSDS

CSDS puts materiality at the core of sustainability reporting.

Under CSDS, information is considered material if it:

- Could affect investment or lending decisions.

- Influences the company’s cash flows, access to capital, or cost of capital.

Materiality is also defined as entity-specific and context-driven. Companies must assess it based on their own operations, risks, and value chain—not based on generic thresholds.

Companies must conduct a materiality assessment to:

- Identify ESG topics that are financially relevant.

- Align disclosure with investor needs.

- Avoid disclosing irrelevant or excessive information.

CSDS vs. ISSB vs. GRI: Key Differences at a Glance

| Feature | CSDS (Canada) | ISSB (IFRS S1/S2) | GRI (Global Reporting Initiative) |

| Jurisdiction | Canada (CSSB) | Global (IFRS Foundation) | Global (GRI Foundation) |

| Nature | Financial materiality focus | Financial materiality focus | Double materiality (financial + impact) |

| Scope | All sectors, initial focus on climate | All sectors, initial focus on climate | Broad sustainability |

| Required Disclosures | Governance, strategy, risk, metrics | Same (via S1 & S2) | Topic-specific disclosures |

| Integration with Financials | Yes (same reporting entity/timeline) | Yes | Typically separate from financials |

| Voluntary/Mandatory | Voluntary for now | Voluntary unless mandated | Voluntary unless regulated |

| Status in Canada | Domestic adaptation of ISSB | Influenced CSDS | Still widely used; may be phased out or complemented by CSDS/ISSB. |

How to Prepare for CSDS: A 5-Step Roadmap

- Assess ESG Maturity and Governance Readiness

Begin with an internal evaluation of your ESG maturity. Identify who owns sustainability in your organization, current reporting practices, and board-level oversight. Strengthen governance if needed. - Conduct a Financial Materiality Assessment

Use CSDS’s definition of materiality to assess which ESG topics affect your company’s enterprise value. Consult internal stakeholders, investors, and risk officers to prioritize disclosures. - Align with CSDS 1 and CSDS 2 Requirements

Map your sustainability strategy and disclosures against CSDS 1’s four pillars (governance, strategy, risk management, metrics) and CSDS 2’s climate-specific disclosures. - Strengthen ESG Data Infrastructure

Centralize ESG data collection. Implement tools or systems that can automate data gathering, validation, and scenario analysis to align with CSDS reporting cadence. - Pilot Your First Integrated Report

Prepare a voluntary CSDS-aligned disclosure alongside your financial report. Use this opportunity to test assurance readiness, stakeholder clarity, and internal alignment.

What’s Next for Canadian Sustainability Reporting

Canada’s leadership in sustainability reporting is evolving. The CSSB’s proposed 2025–2028 Strategic Plan highlights future priorities beyond climate, including biodiversity, human capital, and Indigenous engagement. This plan was open for public comment until April 7, 2025, and stakeholders were encouraged to participate in shaping it.

The Canadian Securities Administrators (CSA) is also expected to launch consultations on expanded climate-related reporting requirements—increasing regulator influence over future ESG disclosures.

These developments signal a broader, more inclusive vision for sustainability in Canada, where non-climate environmental and social issues are gaining recognition as financially material. Companies should monitor regulatory updates and begin building internal capacity for expanded disclosures.

Frequently Asked Questions (FAQs)

Q1: Is CSDS mandatory in 2025?

No. As of now, CSDS is voluntary. The CSA paused mandatory adoption in April 2025 due to global regulatory uncertainties.

Q2: Who should consider adopting CSDS now?

Public companies, large private firms, and those in high-emission or highly scrutinized sectors (finance, energy) should consider early adoption.

Q3: Can we use CSDS alongside GRI or TCFD?

Yes. CSDS is aligned with IFRS S1/S2 and can complement frameworks like GRI or TCFD if your stakeholders expect broader disclosures.

Q4: What if we don’t have full ESG data yet?

Start with what’s available. CSDS allows for transition relief and phased-in adoption of complex data such as Scope 3 emissions.

Q5: Is assurance required for CSDS reports?

Assurance is not currently required but is encouraged. You may want to engage internal audit or external reviewers to validate your disclosures.

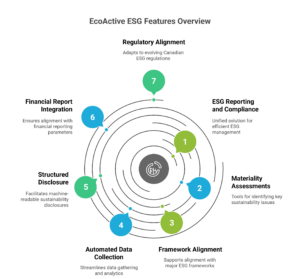

How EcoActive ESG Supports CSDS Implementation

EcoActive ESG plays a vital role in helping Canadian businesses transition smoothly into CSDS-aligned sustainability reporting. Here’s how the platform supports implementation and enhances reporting accuracy:

- End‑to‑End ESG Reporting and Compliance Platform

EcoActive ESG offers a unified solution for managing ESG reporting and compliance efficiently. Its platform is designed for precision and digital readiness. - Materiality & Double Materiality Assessments

The platform includes tools to perform comprehensive ESG and double materiality assessments—essential for identifying key sustainability issues that align with CSDS requirements. - Integrated ESG Framework Alignment

EcoActive ESG supports alignment with major frameworks such as CSDS, ISSB, GRI, and SASB, helping organizations synchronize with both Canadian regulations and global benchmarks. - Automated Data Collection and Analytics

The solution delivers automated templates for ESG data gathering, validation dashboards, peer benchmarking, and analytics—all aimed at minimizing manual effort and strengthening insight. - Structured Disclosure & iXBRL/XBRL Tagging

With inline XBRL integration, EcoActive ESG streamlines preparation of machine‑readable sustainability disclosures—supporting digital reporting and future regulatory submissions. - Seamless Integration with Financial Reports

Reflecting CSDS’s emphasis on connected information, EcoActive ESG ensures ESG disclosures align with financial reporting parameters and use consistent assumptions across documents. - Up-to-Date Regulatory Alignment

The platform is built to accommodate evolving Canadian ESG regulations, including CSA consultation updates, making it agile for expanding disclosure obligations.

Why EcoActive ESG Delivers Value for CSDS Readiness

| Strategic Benefit | How EcoActive ESG Supports It |

| Materiality Alignment | Built-in tools help prioritize financially relevant ESG topics accurately |

| Efficiency & Automation | Automates data collection, dashboards, frameworks, and peer comparisons |

| Digital Compliance Preparedness | Includes iXBRL tagging to support future regulatory filing formats |

| ESG–Finance Integration | Ensures cohesion between sustainability disclosures and financial data |

| Scalable Compliance | Adapts as scope expands—from climate to broader topics like biodiversity |

By aligning directly with CSDS 1 and CSDS 2 requirements—from materiality to structured disclosure—EcoActive ESG equips organizations to not only comply, but lead in credibility and transparency.

Ready to take the next step? Book a personalized demo with EcoActive ESG to see how your organization can accelerate CSDS-aligned reporting.