For decades, the “E” in ESG—Environmental—was largely synonymous with climate change and carbon emissions. But quietly, alongside the climate crisis, another catastrophe has been gaining momentum: the rapid loss of nature and biodiversity.

According to WWF’s 2024 Living Planet Report, the average size of wildlife populations has declined by a staggering 73% between 1970 and 2020, based on data from nearly 35,000 population trends across more than 5,000 vertebrate species. . And approximately $58 trillion—over half of global GDP—is moderately or highly dependent on nature, based on World Economic Forum estimates.

Forests are disappearing. Oceans are warming. Pollinators are vanishing. And businesses—knowingly or unknowingly—are both contributing to and being affected by this ecological decline.

Until recently, there was no global reporting framework focused specifically on how companies depend on nature and impact it in return. That’s where the Taskforce on Nature-related Financial Disclosures (TNFD) steps in.

1. The Birth of TNFD: A Response to the Biodiversity Crisis

The idea for TNFD emerged in 2019–2020 from growing global concern that nature-related risks — like ecosystem collapse, resource scarcity, and biodiversity decline — posed a material threat to economies and societies, just like climate risk.

In July 2020, four organizations formally announced the creation of the TNFD:

- UNDP (United Nations Development Programme)

- UNEP-FI (UN Environment Programme Finance Initiative)

- Global Canopy

- WWF (World Wide Fund for Nature)

Their objective was ambitious yet essential: to build a framework for nature-related risk and impact disclosure that would help redirect global financial flows toward nature-positive outcomes.

By June 2021, TNFD was officially launched with support from the G20, finance ministries, regulators, corporations, scientists, and civil society. The intention was to develop a globally recognized framework—similar to the TCFD for climate—but focused on nature.

2. Framework Development: A Collaborative, Science-Based Approach

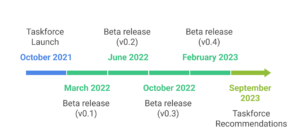

Between 2021 and 2023, the TNFD worked through:

- Four beta versions (the first being Beta v0.1 in March 2022)

- Open consultations with over 200 institutional members of the TNFD Forum

- Collaborations with data scientists, Indigenous groups, conservationists, and regulators

- Alignment efforts with global frameworks like GRI, TCFD, ISSB, and the EU CSRD

The development process emphasized:

- Scientific credibility: grounded in ecological, systems-based thinking

- Business usability: practical for integration into enterprise risk and ESG systems

Global applicability: relevant across sectors, regions, and industries

3. The TNFD Beta v0.1: Introducing the LEAP Framework

In March 2022, the first draft—TNFD Beta v0.1—introduced the core logic of the framework, which has remained foundational: the LEAP approach.

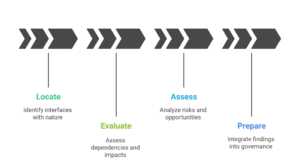

LEAP: The Core Assessment Process

The LEAP acronym stands for:

- Locate: Identify interfaces with nature—e.g., raw materials, supply chains, land use, water bodies

- Evaluate: Assess dependencies (e.g., pollination, water access) and impacts (e.g., habitat destruction)

- Assess: Analyze nature-related risks and opportunities across time horizons and geographies

- Prepare: Integrate findings into governance, strategy, and disclosures

This process is non-linear, iterative, and scalable. It enables ESG teams to go beyond surface-level data and truly operationalize nature thinking.

4. ESG Pillars Reinforced Through TNFD

Unlike financial-only frameworks, TNFD supports all three ESG pillars:

✔️ Environmental (E):

- Goes beyond emissions and energy to cover biodiversity, ecosystems, water, land use, and waste

- Supports disclosures aligned with European Union’s European Sustainability Reporting Standards: E4 – Biodiversity and Ecosystems(EU ESRS E4), Global Reporting Initiative Standard 304: Biodiversity (GRI 304), and Science-Based Targets Network (SBTN)

✔️ Social (S):

- Recognizes the role of local communities, Indigenous rights, and environmental justice

- Encourages stakeholder engagement in risk assessments and site-specific nature impact mapping

✔️ Governance (G):

- Promotes board-level responsibility and oversight of nature-related risks

- Aligns with fiduciary duties increasingly recognized in global legal systems (e.g., UK legal opinion on biodiversity risk governance)

5. TNFD vs TCFD and the Global Regulatory Landscape

The Taskforce on Nature-related Financial Disclosures (TNFD) and the Taskforce on Climate-related Financial Disclosures (TCFD) share structural similarities but differ in scope and intent. Here’s how they compare:

| Feature | TCFD | TNFD |

| Focus | Climate-related financial risks | Nature-related risks, impacts, and dependencies |

| Scope | Single materiality (financial impact only) | Double materiality (impact on and from nature) |

| Structure | 4 Pillars (Governance, Strategy, Risk, Metrics) | Same 4 Pillars |

| Voluntary vs. Regulatory Use | Widely adopted, integrated into regulations | Voluntary but rapidly gaining regulatory support |

| Guidance | Scenario analysis, transition risk | LEAP approach, location-specific, ecosystems focus |

This alignment ensures efficiency and consistency across the ESG reporting ecosystem, while also encouraging companies to address both climate and nature in an integrated way.

Regulatory Landscape: EU, UK & USA

- European Union (EU): The EU’s Corporate Sustainability Reporting Directive (CSRD) includes specific standards (ESRS E4) requiring companies to disclose biodiversity and nature-related impacts. These align closely with TNFD principles.

- United Kingdom (UK): The UK government has signaled strong support for TNFD, with potential future integration into its sustainable finance roadmap.

- United States (US): While no federal mandates require TNFD disclosures yet, large corporations and financial institutions are beginning to voluntarily align with TNFD, especially in sectors with high environmental exposure.

6. What TNFD Recommends Disclosing

The Taskforce on Nature-related Financial Disclosures (TNFD) recommends a total of 14 specific disclosures structured across the four pillars. Here’s the breakdown:

1. Governance (3 disclosures)

- Board’s oversight of nature-related issues.

- Management’s role in assessing and managing these issues.

- Engagement with stakeholders regarding nature-related dependencies, impacts, risks, and opportunities.

2. Strategy (4 disclosures)

- Identification of nature-related dependencies, impacts, risks, and opportunities.

- Effects on business model and financial planning.

- Resilience of strategy to nature-related risks.

- Locations of priority assets and activities.

3. Risk and Impact Management (3 disclosures)

- Processes for identifying and assessing nature-related issues in operations.

- Monitoring of nature-related dependencies and impacts.

- Integration of risk processes into overall management.

4. Metrics and Targets (4 disclosures)

- Metrics for assessing and managing nature-related risks.

- Metrics for assessing dependencies and impacts on nature.

- Targets to manage these issues.

- Performance against these targets.

Each disclosure helps companies communicate how nature considerations are integrated into their decisions—moving from intention to accountability.

TNFD also offers guidance on:

- Scenario analysis for nature risks

- Geospatial data usage

- Transition planning for nature-positive strategies

7. Where We Are Now (2025): Adoption & Future Direction

Current Status:

- Final TNFD recommendations released: September 2023

- Voluntary disclosures underway in 2024–2025

- Over 400+ companies and financial institutions engaged (official TNFD update)

- ESG ratings and regulators beginning to integrate TNFD-aligned metrics

What’s Next:

- Likely integration into mandatory reporting regimes, including the EU’s CSRD (via ESRS E4), the UK’s Green Finance Strategy and upcoming SDR, and potential future ISSB updates beyond IFRS S1 and S2

- Expansion of sector-specific guidance, particularly for high-impact sectors like food, agriculture, forestry, and mining

- Rising investor pressure on companies to adopt nature-positive strategies and TNFD-aligned ESG disclosures

8. How ESG Teams Can Get Started

If you’re building or upgrading your ESG program, here’s how to begin:

- Educate your team:

Familiarize cross-functional teams with the LEAP approach and nature dependencies. - Map material topics:

Include biodiversity, water, soil, and land use in your double materiality assessment. - Use LEAP iteratively:

Start with one site, region, or product line. Expand as capacity builds. - Collaborate with local stakeholders:

Nature risk is location-specific. Community voices, especially Indigenous groups, matter. - Align disclosures gradually:

Start voluntarily. Map TNFD disclosures against existing frameworks (GRI, CSRD, ISSB).

How EcoActive Can Help

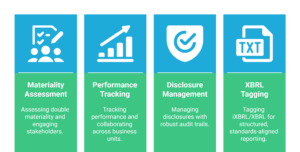

EcoActive ESG simplifies the complexities of ESG reporting through an AI-powered platform designed to streamline:

- Double materiality assessments and stakeholder engagement

- Performance tracking and collaboration across business units

- Disclosure management with robust audit trails

- iXBRL/XBRL tagging for structured, standards-aligned reporting

Whether you’re just starting your ESG journey or scaling reporting efforts enterprise-wide, EcoActive provides a structured, intelligent pathway to efficient, high-quality ESG disclosures.

Conclusion: From Nature Risk to Nature Resilience

The TNFD represents an important evolution in ESG reporting, expanding the focus to explicitly include biodiversity and ecosystem considerations. Rather than replacing climate-focused conversations, it expands the ESG agenda to include biodiversity and ecosystem health as core topics.

By integrating nature into decision-making processes, the TNFD helps organizations become not only nature-aware but also nature-positive—embedding planetary boundaries and ecological responsibility into their strategies and governance systems.

As we move through 2025 and beyond, early adopters of TNFD aren’t just reporting. They’re leading.

Want help aligning with TNFD or building your ESG strategy?

Let’s work together to make your disclosures meaningful, actionable, and future-ready. Book your walk-through here.