Why Agentic AI Is Becoming Foundational

Key points:

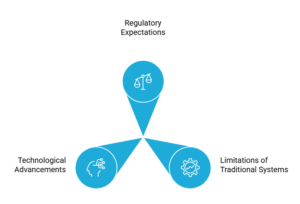

- Regulatory expectations are accelerating across CSRD, ISSB, ESEF, and U.S. state mandates like California’s SB-253 and SB-261.

- Traditional reporting systems cannot support complex, high-frequency, multi-jurisdiction workflows.

- Agentic AI introduces workflow-native intelligence that governs, aligns, and validates disclosures end-to-end.

As global disclosure expectations intensify, enterprises face a convergence of financial and sustainability mandates that require precision, agility, and transparent control. Compliance today is not merely a technical obligation — it is a reflection of enterprise credibility. And the complexity of meeting these requirements across multiple jurisdictions has outgrown the capabilities of legacy, document-driven systems.

Agentic AI addresses this gap by embedding intelligence directly into the disclosure lifecycle. Unlike add-on AI tools that automate isolated tasks, agentic AI governs the workflow itself — interpreting requirements, coordinating steps, validating data, and preserving alignment between finance and sustainability narratives. This marks a shift from manual orchestration to intelligent, guided operations that significantly reduce the risk of inconsistencies, omissions, and late-cycle failures.

Because regulations are evolving faster than enterprise processes can adapt, organizations now require AI that understands context, enforces controls, and brings together previously siloed domains. Agentic AI becomes the connective fabric that ensures disclosures are accurate, complete, assured, and ready for regulatory scrutiny across global mandates.

From Fragmentation to One Controlled Environment

Key points:

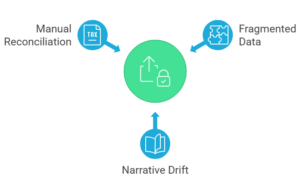

- Most enterprises operate with multiple disconnected reporting tools.

- Fragmented data, narrative drift, and manual reconciliation increase regulatory exposure.

- Agentic AI enables a single governed environment across Finance, Sustainability, and Assurance.

Fragmentation is one of the biggest structural risks in enterprise reporting today. Disconnected systems lead to inconsistent data, divergent narratives, unclear version histories, and inefficient workflows — all of which become visible in the final stages of reporting, when it is too late to fix them without significant delay.

The rise of mandatory assurance under CSRD and the data-intensive requirements of California’s climate laws further expose the limitations of this patchwork approach.

Agentic AI consolidates all reporting activities into a single environment, bringing governance, data integrity, and process logic under one roof. This creates end-to-end continuity — from data intake to narrative drafting, from review cycles to digital tagging — ensuring that information is consistent within each domain and aligned across both Finance and Sustainability. A unified environment drastically reduces rework, improves internal controls, and establishes an enterprise-level foundation for trustworthy disclosures.

When enterprises shift to a single intelligent workflow, reporting transforms from a manual, high-risk process into a controlled, predictable, and strategically valuable capability.

A Strategic Advantage for Modern Leadership

Key points:

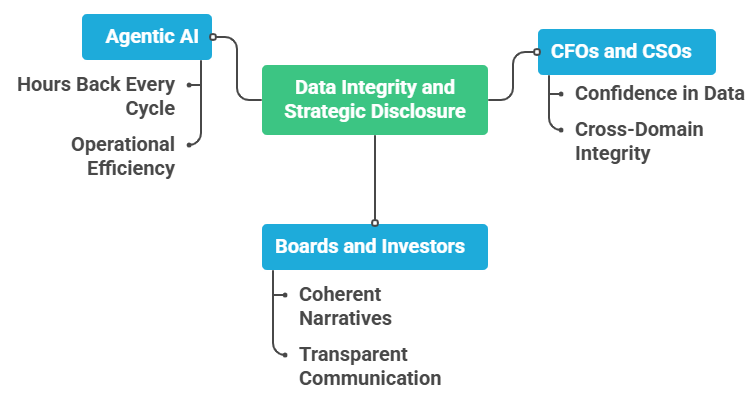

- CFOs and CSOs need confidence in data integrity across domains.

- Boards and investors expect coherent, transparent narratives.

- Agentic AI elevates disclosure from operational burden to strategic asset.

C-suite leaders are under pressure to deliver disclosures that meet regulatory expectations while also communicating a clear, cohesive story to stakeholders. Finance and Sustainability functions, historically separated, must now operate in sync — sharing data, aligning narratives, & jointly demonstrating accountability for risk and performance.

C-suite leaders are under pressure to deliver disclosures that meet regulatory expectations while also communicating a clear, cohesive story to stakeholders. Finance and Sustainability functions, historically separated, must now operate in sync — sharing data, aligning narratives, & jointly demonstrating accountability for risk and performance.

Agentic AI enables leadership to shift their focus from mechanics to meaning. With AI coordinating workflows, validating inputs, and preserving cross-domain consistency, leaders gain earlier visibility into risk, improved auditability, and the confidence that what they publish is both accurate and defensible. The result is not only reduced regulatory exposure but also a stronger strategic signal to the market: that the organization understands its performance, its risks, and its responsibilities.

The future of enterprise disclosure will not be driven by manual effort but by intelligence that transforms compliance into clarity — and complexity into confidence.

How EcoActive’s Agentic AI Is Redefining Enterprise Disclosure

Key points:

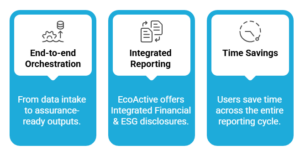

•Enterprises gain end-to-end orchestration: from data intake and assessments to narrative drafting, tagging, and assurance-ready outputs.

- EcoActive supports integrated reporting – financial and non-financial/ESG disclosures in one environment.

- Users save time across the entire cycle: scoping, data collection, drafting, reviews, and digital filing.

Ez-XBRL Solutions and EcoActive have jointly launched an agentic-AI enabled disclosure management platform that gives CFOs, CSOs, and sustainability leaders a single, controlled environment to prepare, review, and publish integrated financial and sustainability disclosures across jurisdictions. Designed for control, transparency, and speed, the platform embeds Agentic AI across the entire lifecycle— from scoping and assessments to filing and assurance—so every stage is supported by intelligent, guided workflows instead of manually stitched-together tools. This agentic-AI powered environment turns disclosure into a repeatable, time-efficient process, allowing organizations to spend less time on mechanics and more on understanding performance, explaining risks and opportunities, and communicating a credible story to regulators, investors, and stakeholders.

Ez-XBRL Solutions and EcoActive have jointly launched an agentic-AI enabled disclosure management platform that gives CFOs, CSOs, and sustainability leaders a single, controlled environment to prepare, review, and publish integrated financial and sustainability disclosures across jurisdictions. Designed for control, transparency, and speed, the platform embeds Agentic AI across the entire lifecycle— from scoping and assessments to filing and assurance—so every stage is supported by intelligent, guided workflows instead of manually stitched-together tools. This agentic-AI powered environment turns disclosure into a repeatable, time-efficient process, allowing organizations to spend less time on mechanics and more on understanding performance, explaining risks and opportunities, and communicating a credible story to regulators, investors, and stakeholders.

Because EcoActive offers integrated reporting, teams don’t have to jump between systems for financial and non-financial data. Finance and Sustainability can work in the same controlled environment, where Agentic AI helps them interpret requirements, map indicators, and maintain consistent narratives across CSRD/ESRS, ISSB, ESEF, BRSR, and other frameworks. This eliminates a large portion of the time usually lost in reconciling spreadsheets, emails, and parallel tools.

Alongside multiple other AI capabilities, EcoActive’s modules such as double materiality, integrated GHG calculator, policy and target management, analytics dashboards, and report generation—provide the end-to-end backbone that Agentic AI uses to orchestrate, validate, and streamline the entire disclosure process.

EcoActive’s Agentic-AI platform does not simply help companies “keep up” with disclosure requirements — it helps them lead with clarity, confidence, and credibility.

See how a unified, AI-enabled workflow can transform your financial and sustainability reporting.

👉 Explore EcoActive — Request a demo