Introduction

The Corporate Sustainability Reporting Directive (CSRD) continues to evolve. In 2025, the EU introduced a broad Omnibus simplification package and a targeted “quick-fix/stop-the-clock” amendment that adjusts aspects of CSRD timing and reduces reporting burden, while keeping the core objective—decision-useful, investor-grade sustainability information—intact. For listed companies across Europe the challenge is the same: integrating financial and ESG data into a single, iXBRL-tagged report, aligned to ESRS, subject to assurance—and doing it within an updated, but still demanding, timetable.

That’s where EcoActive makes a difference. Purpose-built for integrated disclosure, EcoActive unites financial and sustainability reporting in one solution: auto-iXBRL tagging, layout retention, audit readiness, and cross-department collaboration. By turning compliance into clarity, EcoActive helps EU leaders in finance, ESG, and corporate communications position their companies as transparent, compliant, and future-ready.

In this blog, you’ll get:

- The current regulatory context (post-Omnibus),

- The top challenges European issuers face now,

- Four steps to readiness, and

- how EcoActive supports every stage.

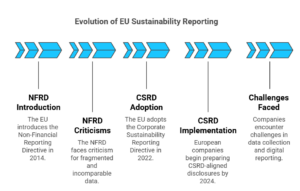

A Brief Historical Perspective

The EU’s journey toward sustainability reporting started with the Non-Financial Reporting Directive (NFRD) in 2014, which required a limited set of large public-interest entities to disclose ESG information. However, the NFRD was quickly criticized for producing fragmented, incomparable, and often boilerplate data. For European listed companies, this meant ESG reporting was more of a compliance checkbox than a tool for investor trust or stakeholder engagement.

The adoption of the Corporate Sustainability Reporting Directive (CSRD) in 2022 marked a turning point. CSRD significantly expanded scope, requiring all European listed companies to report under standardized European Sustainability Reporting Standards (ESRS). By 2024, European issuers began preparing their first CSRD-aligned disclosures, but not without challenges:

- Data collection and quality gaps, as ESG data was often scattered across multiple systems and subsidiaries.

- Double materiality assessments, which required companies to analyze both financial impacts of sustainability issues and their broader environmental/social impacts.

- Digital reporting requirements, with iXBRL tagging demanding significant investment in systems and skills.

- Assurance readiness, as auditors now had to provide limited assurance, raising the bar for internal controls and accuracy.

CSRD in 2025: What Changed (and What Didn’t)

Omnibus simplification (2025) aims to cut reporting burdens (25% overall; more for SMEs) and streamline sustainability rules across CSRD, EU Taxonomy and related files. A “quick-fix”/stop-the-clock measure has adjusted parts of the CSRD timetable and authorised simplifications to ESRS, without removing the core obligations (iXBRL digital reporting, assurance, double materiality). Meanwhile, EFRAG is running a 2025 consultation on revised/simplified ESRS, with final technical advice due to the Commission by late 2025.

Some proposals under Omnibus also re-calibrate scope thresholds (e.g., discussing higher employee/turnover bars), which—if adopted as drafted—could narrow the pool in future waves. Until final texts are enacted and transposed, European listed companies should plan under current CSRD scope and ESRS while monitoring the EU process.

Bottom line: CSRD is not going away. Expect simpler standards, minor timeline adjustments, and continued digital/assured reporting.

The Impact on European Listed Companies

Across Europe, CSRD raises the bar for consistency, comparability, and auditability—well beyond prior ESG disclosure practices. Denmark, for example, transposed CSRD into its Financial Statements Act in 2024, giving us an early view of how statutory expectations are being embedded at the national level.

Key timing signals (EU-level, 2025 landscape):

- Stop-the-clock/quick-fix adopted (April–July 2025): targeted adjustments to CSRD timing and implementation mechanics.

- ESRS simplification underway (Q3 2025): EFRAG public consultation on revised ESRS before Commission action.

- Omnibus track (from Feb 2025): broader burden-reduction proposals moving through the EU process.

For European issuers, that translates to persistent pressure on data quality, audit trails, governance and iXBRL—with modest relief on complexity likely in the next cycles, not this one.

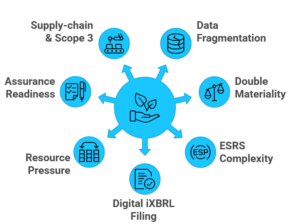

CSRD Challenges European Public Companies Face in 2025

- Data fragmentation & auditability — Finance, ESG, HR and Ops data live in silos; CSRD requires traceability suitable for assurance.

- Double materiality done right — Integrating financial materiality with impact materiality under ESRS—now being simplified, but still method-heavy.

- ESRS complexity amid change — You must comply today while standards are being revised; version control and narrative stability are hard.

- Digital iXBRL filing — Tagging precision, validations and regulator-ready export remain new for many filers.

- Resource pressure — Smaller listed companies face limited bandwidth; Omnibus aims to help, but not in time to skip robust prep.

- Assurance readiness — External assurance demands defensible controls, evidence, and change logs.

- Supply-chain & Scope 3 — Even if simplified, investor expectations still push for transparency on value-chain impacts.

Four Steps to CSRD Readiness — Powered by EcoActive

1) Build a Cross-Functional CSRD Roadmap

Create a task force spanning finance, ESG, compliance, IR and comms. In EcoActive, define owners, due dates and governance checkpoints; map milestones end-to-end (double materiality → data collection → iXBRL tagging → narrative → assurance → submission). This shifts you from spreadsheet chaos to a single accountable plan.

2) Streamline Workflows with Centralised Templates

CSRD requires integrated reporting. EcoActive provides structured iXBRL-ready templates aligned to ESRS + financial statements, consolidating data capture, validations and drafting. One platform = one source of truth, robust version history, and audit-ready evidence.

3) Leverage Smart Automation & Layout Retention

Replace error-prone manual steps with automation:

- Auto-iXBRL tagging & validation for accurate taxonomy use and instant error flags.

- Round-tripping InDesign to keep publication-quality layouts without breaking tags.

- End-to-end orchestration from imports to final export, plus collaboration so Finance/ESG/IR work from the same dataset.

- Assurance readiness through embedded controls, logs and traceability.

This turns compliance into a repeatable, scalable capability—critical while ESRS evolves.

4) Embed Governance through Strategy-Driven Transparency

CSRD success isn’t a one-time effort—it relies on structured governance, trusted data, and active decision support. EcoActive brings these together with features inspired directly by its “Integrated Financial and ESG Reporting in 2025” overview:

- Automated data checks & consistency validation—EcoActive runs real-time checks to reduce discrepancies and strengthen trust in reported numbers.

- Real-Time Dashboards—Decision-makers get consolidated, up-to-date views of ESG + financial performance, helping governance bodies make informed approvals.

- AI-Driven Insights & Benchmarking—EcoActive offers predictive analysis, peer comparisons, and trend tracking, equipping governance teams to align reporting quality with strategy.

- End-to-End Workflow Orchestration—From data capture to final submission, EcoActive supports every governance checkpoint—ensuring traceability, audit readiness, and control.

Governance becomes proactive, not reactive. With EcoActive, boards and sustainability committees gain transparent access to controls, data consistency, and strategic insights—so reporting is always decision-ready.

Why Act Now: From Compliance to Advantage

Omnibus may lighten the load, but investors, lenders and EU stakeholders still expect coherent, comparable, assured information. Acting now with EcoActive delivers:

- Regulatory peace of mind—ESRS-aligned, iXBRL-tagged, assurance-ready filings.

- Efficiency—less manual work, fewer last-minute fixes, faster cycles.

- Credibility—transparent disclosures that support funding and valuations.

- Resilience—a platform that adapts as ESRS simplifications and Omnibus changes are finalised.

Conclusion

Is your company prepared for CSRD reporting in Europe?

EcoActive equips listed companies with:

- End-to-end CSRD roadmaps, from double materiality to submission.

- Integrated iXBRL automation and layout retention.

- Workflow orchestration across finance, ESG, IR and compliance.

- Tools that future-proof disclosures as ESRS and Omnibus changes take effect.

📞 Book a consultation with our experts to assess your current reporting setup.

EcoActive turns CSRD compliance into clarity, credibility, and competitive advantage.

FAQs on CSRD in Europe (Updated for 2025)

1) What did the 2025 Omnibus change for CSRD?

The Commission’s Omnibus package targets burden reduction and streamlining across sustainability laws. A quick-fix/stop-the-clock measure adjusts aspects of CSRD timing; broader Omnibus proposals are progressing through the EU process. Core elements—ESRS-based reporting, iXBRL, assurance—remain.

2) Are ESRS requirements being simplified?

Yes. EFRAG launched a 2025 consultation on revised/simplified ESRS with technical advice due to the Commission by late 2025. Expect simplifications, not a repeal of the standardised approach.

3) Do EU companies still need iXBRL?

Yes. Digital, tagged reporting (iXBRL) remains central for comparability and supervision—even under simplification efforts.

4) Could scope thresholds change?

Some Omnibus discussions include higher thresholds that could narrow scope in later waves. Until final texts are adopted and transposed, plan under current CSRD scope and keep monitoring.

5) What’s the practical takeaway for 2025 filings?

Proceed with current ESRS + iXBRL requirements, build assurance-ready processes, and use a platform (like EcoActive) that can absorb ESRS/Omnibus updates next cycle without re-engineering your workflow.