For years, companies have managed financial reporting and sustainability reporting as two completely separate work streams—different teams, different systems, and different reports. Annual reports focus on revenue, margins, risks, and financial results, while ESG reports cover emissions, workforce, supply chain, and community impact. This split creates a fragmented view of the business: inconsistent messages, duplicated effort, and data scattered across spreadsheets, emails, and siloed departments. As stakeholder expectations rise and assurance requirements tighten, this disconnected approach is no longer strategically viable.

The future belongs to integrated reporting that unify financial and sustainability performance to present a complete, credible, and investment-ready picture of the business. This blog explores why integrated reporting is no longer optional—and why companies that embrace it today will gain a strategic edge in transparency, resilience, and value creation.

Top Challenges When ESG and Finance Operate in Separate Systems

1. Fragmented View of Performance

When financial metrics live in one system and ESG in another, organizations struggle to present a unified story of enterprise performance.

- Sustainability teams may be tracking emissions, energy use, diversity ratios, or community impact.

- Finance teams are monitoring profitability, cash flow, cost structures, and risk exposures.

Without integration, the company cannot connect ESG initiatives with financial outcomes—for example:

- How energy savings affect operating expenses

- How climate risks influence asset valuation

- How employee well-being impacts productivity and retention

This fragmented picture results in reports that lack strategic coherence and fail to demonstrate the true impact of ESG investments.

2. Inefficient, Repetitive Data Processes

Separate reporting teams usually end up collecting the same data multiple times, but in different formats, templates, or timelines.

Manual spreadsheets, email follow-ups, and last-minute reconciliations lead to:

- Data inconsistencies

- Version conflicts

- High quality-control effort

- Delayed reporting cycles

This is particularly challenging in ESG, where the volume and frequency of data collection are significantly higher. Without an integrated system, the reporting burden increases every year.

3. Higher Cost of Reporting & Assurance

Disjointed systems require more:

- Resources

- Consultant intervention

- Auditor effort

- Time from internal teams

Assurance becomes expensive because auditors must trace data across multiple tools, spreadsheets, and unstructured files. Organizations pay heavily for what could be avoided using a unified digital solution with automated controls and validations.

4. Difficulty in Meeting Regulatory Expectations

With global regulators and standard-setters—such as the EU’s ESRS under the Corporate Sustainability Reporting Directive (CSRD), the IFRS Foundation’s ISSB Standards (IFRS S1 and S2)—continuing to expand and tighten disclosure requirements, companies must demonstrate:

- Auditability

- Timeliness

- Accuracy

- Consistency

When finance and ESG operate separately, regulators may consider disclosures incomplete or unreliable. Manual workflows increase the risk of errors, making it harder to comply with evolving standards.

5. Inability to Demonstrate ESG ROI

Leadership increasingly asks: “What financial value is ESG creating?”

But without integrated data, companies cannot effectively show:

- Cost savings from energy efficiency projects

- Financial risks mitigated by climate initiatives

- Value creation from sustainable supply chains

- Revenue impact from new green products

This directly affects investor confidence, budgeting decisions, and long-term sustainability planning.

Why Integrated Solutions Are the Future

An integrated Finance + ESG ecosystem addresses these challenges by breaking silos, automating processes, and generating a 360-degree view of business performance. Here’s how an integrated platform solves the core issues:

1. Solving Fragmented Performance View

Integrated systems combine financial, operational, and ESG insights into a single source of truth.

This enables organizations to:

- Link climate and sustainability metrics with financial KPIs

- Connect GHG reduction with lower operational costs

- Map ESG initiatives to business outcomes

Management gains a unified sustainability-linked financial narrative, strengthening investor trust.

2. Eliminating Repetitive Data Processes

With automated data pipelines and shared workflows:

- Finance and ESG teams access the same data sources

- Data is collected once and reused across all reporting frameworks

- Redundant tasks disappear

- Manual quality checks reduce significantly

The result is highly efficient, error-free reporting cycles.

3. Reducing Cost of Reporting & Assurance

When Finance and ESG share a single integrated platform, internal controls and assurance readiness are streamlined:

- Built-in validations

- Automated audit trails

- Centralized documentation

- Logging for every data touchpoint

Together, these features reduce the effort required during internal review and external assurance, bringing down costs and timelines for both teams and auditors.

4. Simplifying Regulatory Compliance

When Finance and ESG operate on a single integrated platform, regulatory compliance becomes far more streamlined and reliable. Organizations can seamlessly map financial disclosures and ESG data to multiple frameworks:

- ESRS

- BRSR

- ISSB

- IFRS

The same unified dataset supports both sustainability reporting and finance-grade assurance requirements, ensuring that every number—financial or non-financial—is consistent, traceable, and audit-ready. Because all data flows through one controlled environment, updates to evolving regulations are easier to implement, significantly reducing the risk of inconsistencies or last-minute corrections. This integration ensures the organization meets regulatory expectations confidently and with far less effort.

5. Demonstrating ESG ROI Clearly

Integrated platforms provide insights and analytics that reveal how sustainability initiatives affect the bottom line:

- Cost-benefit analysis

- Benchmarking performance against peers

- Scenario modeling

- Carbon price exposure

- Resource efficiency gains

This helps leadership justify ESG budgets and accelerate sustainability investments.

How EcoActive Enables Integrated Reporting — An End-to-End Strategic Platform

EcoActive is built to unify Finance and ESG reporting seamlessly. It eliminates manual methods and empowers organizations to scale their reporting efficiently with advanced automation, intelligent analytics, and collaborative workflows.

Below are the core capabilities that make EcoActive the future of integrated reporting:

1. Unified Platform for ESG and Finance

EcoActive combines financial and non-financial reporting under a single architecture.

Both teams access:

- Shared data libraries

- Common controls

- Unified dashboards

- Centralized reporting structures

This ensures consistency across sustainability disclosures, financial statements, internal reporting, and stakeholder communication.

2. Collaborative Working Environment

Finance, sustainability, compliance, and risk teams work together within one platform.

Features include:

- Role-based access

- Commenting and review workflows

- Version control

- Task management

This breaks the traditional silo between Finance and ESG teams, making workflows faster and more transparent.

3. Seamless Data Integration

EcoActive connects directly with ERP systems. This enables real-time, automated inflow of accurate data without spreadsheets or fragmented templates.

4. Automated Data Collection

The platform dramatically reduces manual effort by enabling:

- Auto-populated fields

- Gap analysis and Peer Benchmarking

- In-built validations

- Auto-flow of data into all required reports

Data entered once becomes available across all relevant reports and frameworks.

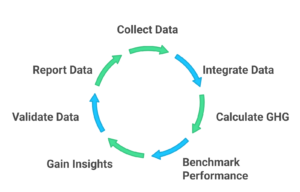

5. Integrated GHG Calculator

EcoActive’s GHG engine supports:

- Scope 1, Scope 2, Scope 3 emissions

- Location-based and market-based methods

- Global emission factors

- Audit-ready calculation logic

Organizations can quantify, manage, and reduce emissions with confidence.

6. Peer Benchmarking and AI Insights

EcoActive uses advanced AI to deliver:

- Peer benchmarking

- Trend Analysis

- Predictive analytics

These insights help companies make better decisions and elevate their ESG maturity.

7. iXBRL Enabled

EcoActive embeds XBRL/iXBRL from the beginning, helping organizations:

- Produce regulator-ready digital filings

- Ensure structured, machine-readable reporting

- Reduce turnaround time for compliance submissions

This is especially relevant for ESRS, ISSB, CARB BRSR, and upcoming XBRL mandates globally.

8. Built-in Validations

The system applies automated validations at:

- Data ingestion

- Data collection

- Reporting stage

This improves data accuracy early on and eliminates end-cycle corrections that traditionally delay reporting.

9. Agentic AI Enabled

EcoActive delivers a coordinated, intelligence-led reporting environment where workflow-native Agentic AI drives core reporting operations across Finance and ESG. Its AI agents streamline every stage of the process through:

- Data intake and preparation

- Automated authoring and narrative support

- Review and approval workflows

- Reporting with validations at each step

AI assists both Finance and ESG teams, reducing effort and improving report quality.

Conclusion: Integrated Reporting Isn’t Optional—It’s a Strategic Imperative

The global shift toward integrated reporting represents more than compliance—it is a strategic transformation in how companies understand and communicate value. Businesses that align sustainability and finance will be better positioned to secure investor confidence, build resilient operations, respond to regulatory change, and lead the transition to a low-carbon economy.

As regulatory, market, and stakeholder pressures accelerate, the organisations that adopt unified, data-driven platforms today will become tomorrow’s leaders—more resilient, more transparent, and more competitive.

Integrated reporting is no longer optional. It is the foundation of future-ready strategy.

Streamline ESG + Finance Reporting: See EcoActive in Action. Book a Demo