When it comes to ESG, most companies are focused on measuring the now—carbon footprints, diversity metrics, water usage. But in 2025 and beyond, the real differentiator isn’t just what you measure—it’s how well you anticipate the future.

That’s where scenario analysis comes in.

What Is Scenario Analysis?

Scenario analysis and planning is a strategic method that helps organisations explore different future pathways—especially under uncertainty. Instead of relying on a single forecast, it helps companies stress-test their decisions against a range of plausible outcomes, such as extreme weather events, regulatory overhauls, or shifts in consumer sentiment.

Unlike forecasting, which tries to predict the most likely outcome, scenario analysis prepares you for multiple possible futures—so you’re never caught off guard.

Why Scenario Analysis Is Gaining Urgency in 2025

1. Climate Change Is Not a Hypothetical

Climate change isn’t a distant threat—it’s a growing financial liability. According to Forbes, it could cost companies $1.3 trillion annually by 2026 if they fail to take adequate action. From floods and droughts to heatwaves and wildfires, physical climate risks are materialising faster than many organisations anticipated.

Scenario analysis helps simulate how different climate trajectories—like 1.5°C vs. 4°C warming—might impact your assets, operations, and supply chains.

2. TCFD Makes Scenario Analysis a Strategic Imperative

The Task Force on Climate-related Financial Disclosures (TCFD) has played a pivotal role in elevating scenario analysis from a niche strategy tool to a board-level priority. Established by the Financial Stability Board, TCFD provides a global framework for companies to disclose climate-related financial risks and opportunities in a consistent, comparable, and decision-useful manner.

Under TCFD, companies are encouraged to disclose how climate-related risks and opportunities could impact their business under different future scenarios—most notably a 2°C warming scenario. This benchmark reflects the global ambition to limit warming in line with the Paris Agreement and helps organisations assess key transition risks such as policy changes, carbon pricing, and technology shifts.

More and more jurisdictions are aligning their climate disclosure requirements with TCFD, making scenario analysis a critical part of ESG reporting.

For Example: In the UK, premium-listed companies are already required to conduct TCFD-aligned scenario analyses as part of their annual disclosures.

3. Investors Are Rewarding Resilience

Black Rock, the world’s largest asset manager, famously declared that “climate risk is investment risk.” In its Investment Institute insights, Black Rock states that it now integrates climate-aware return expectations into asset allocations and sees climate transition risk as a fundamental driver of long-term value.

Scenario analysis signals to investors that you’re adapting strategically—not just reacting. This proactive posture often translates into greater investor confidence and capital allocation.

Why Consider Environment-Related Scenario Analysis?

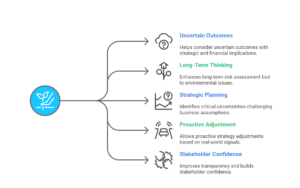

Scenario analysis isn’t just about modelling climate risks—it’s about building strategic resilience. Leading frameworks like TCFD and CDP recommend it because:

- It helps organisations consider highly uncertain outcomes—like physical climate risks or regulatory shifts—that could have significant strategic and financial implications.

- It enhances long-term thinking by pushing companies to assess medium- to long-term risks tied to environmental issues.

- It strengthens strategic planning by identifying critical uncertainties that may challenge business-as-usual assumptions.

- It allows companies to recognise when real-world signals suggest movement toward a particular scenario—helping them adjust strategies proactively.

- It improves transparency and builds stakeholder confidence by showcasing how prepared an organisation is under multiple plausible futures.

This kind of forward-looking analysis can become a powerful tool to future-proof strategy, not just check a compliance box.

Real-World Examples of Scenario Analysis in Action

Unilever

In 2016, Unilever conducted scenario analysis using 2 °C and 4 °C warming pathways to assess climate-related risks, including carbon pricing, raw material cost inflation, and potential supply-chain disruption. The insights gathered were integrated into their strategic decision-making—helping them plan investments, secure sourcing resilience, and enhance long-term sustainability reporting in alignment with TCFD.

Volvo Cars

Volvo Cars applied scenario planning aligned with IEA’s Beyond 2° Scenario (B2DS) to evaluate how climate policy shifts and electrification trends would impact their long-term viability. These scenarios informed Volvo’s transition strategy toward electric vehicles and reinforced their climate disclosures in accordance with TCFD recommendations, enabling investors to assess their readiness for a low-carbon future.

These real-world examples show how global brands are using scenario analysis to manage climate risk.

But how can your company actually apply it in practice?

To bring the concept to life, let’s walk through a hypothetical example of how a company might use scenario analysis to prepare for climate-related risks.

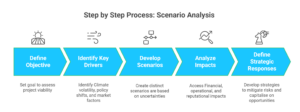

How Scenario Analysis Works: A Step-by-Step Process

Let’s walk through a fictional example using a renewable energy developer—SunGrid Energy, operating in Southeast Asia and Sub-Saharan Africa.

Step 1: Define the Objective

For instance, SunGrid wants to assess how different climate and policy conditions might affect the viability and ROI of its upcoming solar projects over the next 10 years.

Step 2: Identify Key Drivers of Uncertainty

- Climate volatility (e.g., extreme weather disrupting manufacturing or transport)

- Policy shifts (e.g., green subsidy cuts)

- Global solar panel prices and supply chains

- Regional energy demand and competition

Step 3: Develop Scenarios

Create 2–3 distinct, plausible scenarios based on the uncertainties:

Scenario A: Stable Climate & Policy Support

- Climate patterns are stable

- Subsidies continue

- Supply chains function smoothly

Implication: Projects stay on track with strong ROI.

Scenario B: Policy Rollbacks

- Green energy subsidies reduced in key markets

- Capital becomes more expensive

- Rising project costs

Implication: Delay in project approval and ROI uncertainty.

Scenario C: Climate-Driven Supply Disruption

- Severe storms damage panel factories

- Logistics are delayed

- Labor is impacted

Implication: Project timelines slip, costs rise, investor confidence shaken.

Step 4: Analyze Impacts

For each scenario, assess:

- Financial outcomes (ROI, cash flow)

- Operational delays

- Reputational or compliance risks

Step 5: Define Strategic Responses

- Diversify supplier base

- Develop contingency timelines

- Engage policymakers in at-risk regions

- Reallocate resources to low-risk zones

This structured approach helps SunGrid make better, faster decisions—even in a world of uncertainty.

Mapping Possibilities: What Kind of Scenarios Should You Explore?

Not all scenarios are created equal—and not every business faces the same risks. Scenario Analysis works best when you explore a mix of plausible futures tailored to your specific context. Whether you’re assessing climate impacts, policy shifts, or reputation risk, choosing the right scenario categories is key to unlocking meaningful insights and actions.

Types of Scenarios You Can Explore

| Scenario Type | Focus Area |

| Climate Scenarios | 1.5°C, 2°C, 3°C+ warming pathways |

| Regulatory Scenarios | New carbon taxes, climate legislation, ESG mandates |

| Market Scenarios | Consumer behavior shifts, green finance, technology costs |

| Resource Constraints | Water shortages, rare earth availability, energy security |

| Reputation Risk | Stakeholder pressure, media scrutiny, public backlash |

TCFD’s Scenario Analysis Characteristics

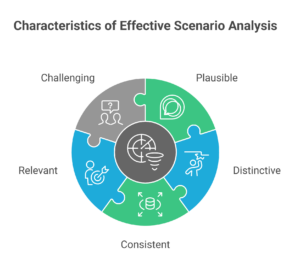

According to the Task Force on Climate-related Financial Disclosures (TCFD), a strong scenario plan should reflect the following characteristics:

- Plausible

The events described in the scenario should be possible and the overall narrative credible. That means the “what happened, why, and how” should feel believable based on known trends or dynamics. - Distinctive

Each scenario should explore a different combination of key driving factors. Scenarios must be clearly differentiated in both structure and message—not just minor variations of a single storyline. - Consistent

Internal logic is essential. The relationships between assumptions, actions, and outcomes should make sense. Shifts in the scenario must have justifiable causes; outcomes should not contradict the evidence of current trends unless logically explained. - Relevant

Scenarios should yield specific insights that relate to strategic or financial implications of climate-related risks and opportunities. They must help decision-makers connect external developments to business outcomes. - Challenging

A good scenario plan pushes leadership to examine and question existing assumptions. It should surface critical uncertainties and explore alternative futures that could significantly diverge from business-as-usual.

Common Pitfalls (And How to Avoid Them)

- Overcomplicating the Models

Start with 2–3 well-researched scenarios. Focus on quality, not quantity. - Treating It Like a One-Off Exercise

Scenario analysis isn’t a “reporting box” to tick. Revisit and refine your scenarios regularly. - Isolating It from Business Strategy

Scenario analysis should shape decisions—not sit in a slide deck. Use it to inform capital allocation, risk management, and growth strategy.

Final Thoughts: The Future Isn’t Fixed—But Your Readiness Can Be

Scenario analysis has emerged as one of the most powerful ESG tools of 2025—because it’s not about predicting the future; it’s about being ready for it.

Whether you’re navigating new climate disclosure rules, preparing for supply chain volatility, or aligning with long-term investor expectations, scenario analysis gives your business a strategic edge in uncertain times.

While many companies are still playing catch-up, the leaders of tomorrow are already modeling what’s next—today.

👉 Explore how EcoActive supports your ESG journey